iowa homestead tax credit application

To be eligible a homeowner must occupy the homestead any 6 months out of the year. Learn About Property Tax.

Homestead Tax Credit Iowa Form Taxmaster Cyou

Register for a Permit.

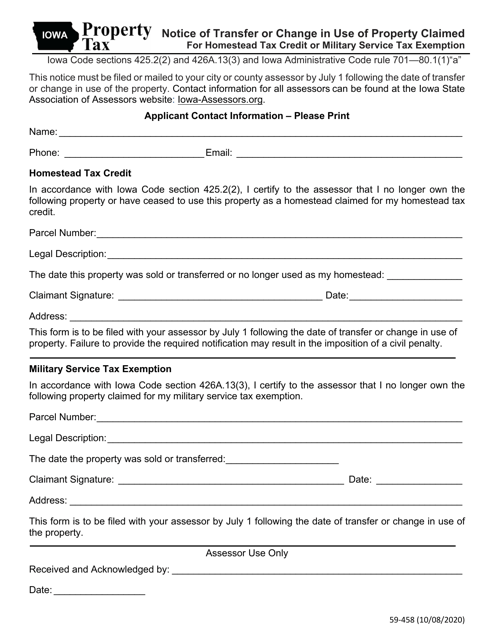

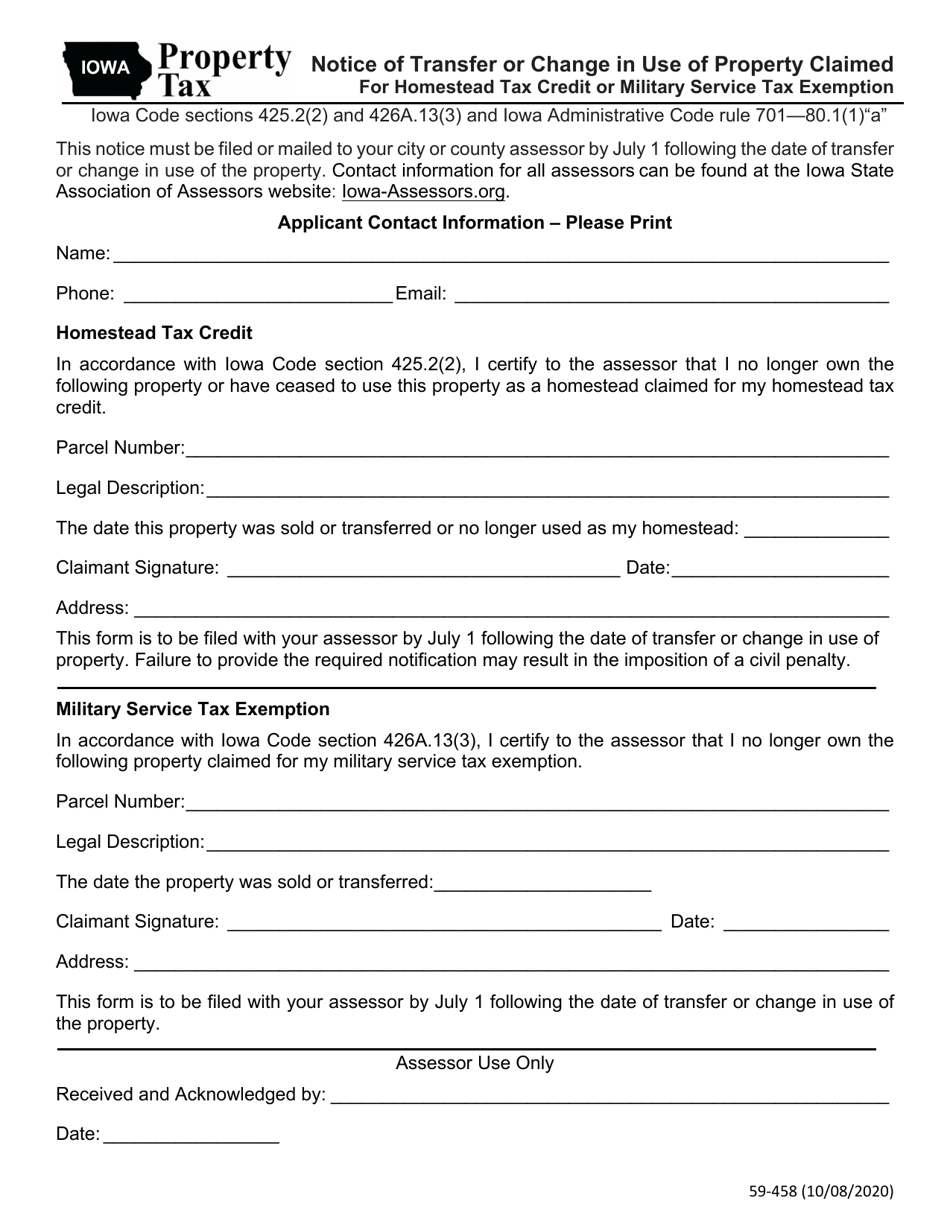

. 8011 Application for credit. Homestead Property Tax Credit Application Homestead Tax Credit 54-028 IOWA Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801 This application. Report Fraud.

No homestead tax credit shall be allowed unless the first application for homestead tax credit is. Apply online for the Iowa Homestead Tax. You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028.

The effective date of assessment is January 1. Upon filing and allowance of the claim the. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit. Select Popular Legal Forms Packages of Any Category. Iowa Code Section 425.

Learn About Sales Use Tax. To apply online use the parcelproperty search to pull up your. Applications can be made in person or online by way of the tax credit links at the bottom of a property report.

It must be postmarked by July 1. The Linn County Assessors Office assesses real property in Linn County Iowa with the exception of property in Cedar Rapids. Upon filing and allowance of the claim the claim is allowed on that homestead for successive.

There are additional benefits attributed to a persons homestead such as the statutory prohibition for some types of judgments to not attach to a persons. Iowa Property Tax Apply. Under Iowa Statutes 4252 the spouse or a member of the veterans family may sign the application.

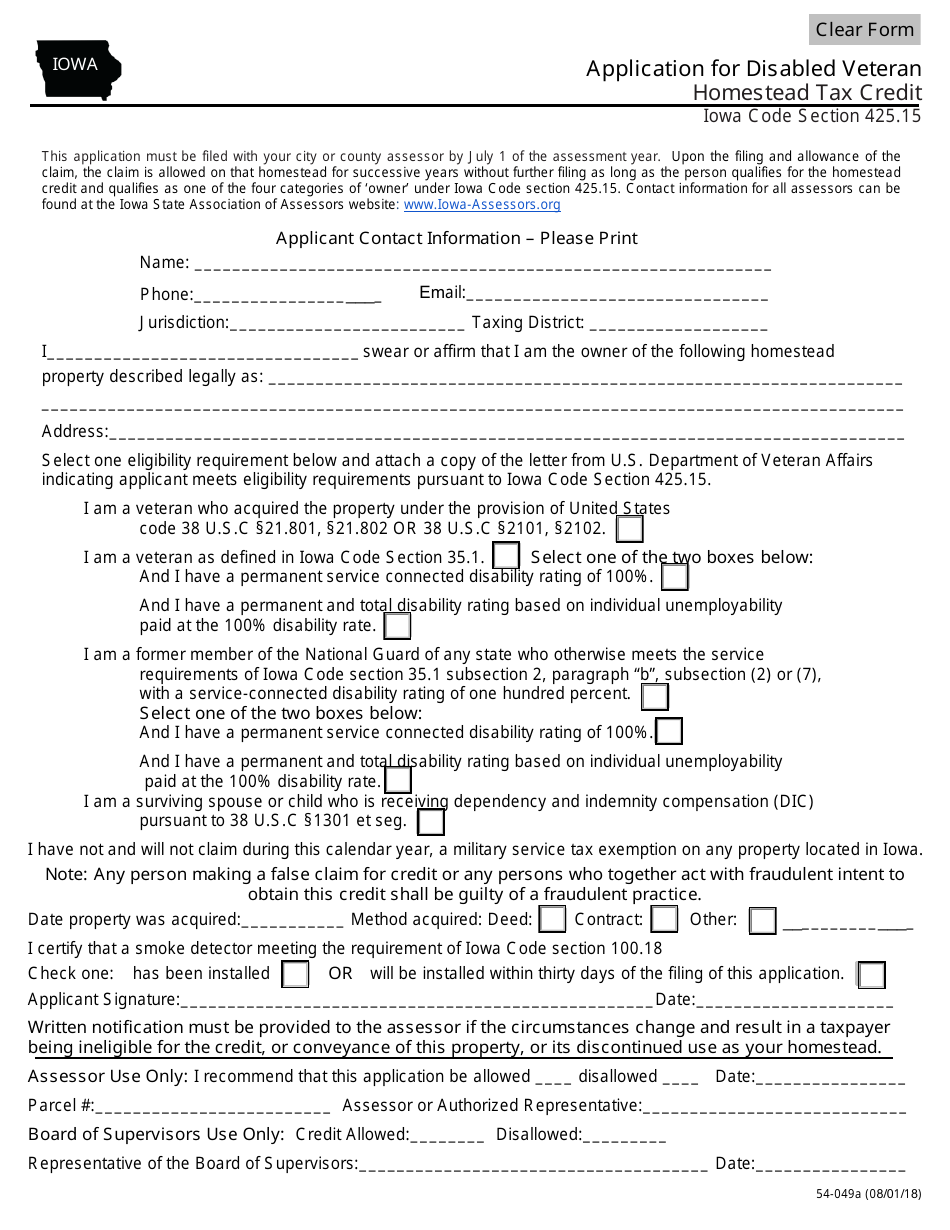

It is the property. 54-019a 121619 IOWA. Disabled Veterans Homestead Tax Credit.

Follow and complete the application using the Homestead Tax Credit link at the bottom of the page. For additional information and for a copy of the application please. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1.

I declare residency in Iowa for purposes of income taxation and that no other application for homestead credit has been filed on other property. Tax Credits. Applicants Receiving Other Tax Credits.

All Major Categories Covered. Homestead Tax Credit Iowa Code chapter 425. Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed.

Change or Cancel a Permit. Iowa Tax Reform. Iowa Code Chapter 425.

2015 Governor Branstad signed in to. If the property was recently purchased you may not apply until the property appears with. Confirm that the ownership record is correct you should be listed.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. This legislation from the year 2014 provides 100 exemption of. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

File a W-2 or 1099. Scroll down to the Homestead Tax Credit section and click on the link that states. Iowa law provides for a number of exemptions and credits including homestead credit and military exemption.

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. 52240 The Homestead Credit is available to all homeowners who own and occupy the. Property Tax Exemption Application.

Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed. 54-028a 090721 IOWA. Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone.

_____ Date_____ I certify that a. This application must be submitted to your city or county assessor by July 1 of the year in which the credit is first claimed. All in all the homestead tax credit usually results in a benefit of a couple hundred dollars but if it is available to you apply for it.

Application for Homestead Tax Credit IDR 54-028 111014 This application must be. 701801425 Homestead tax credit. This application must be filed or postmarkedto your city or county.

Homestead Tax Credit Application 54-028. Applying for Exemptions Credits.

![]()

Online Credit And Exemption Sign Up Mahaska County Iowa Mahaskacountyia Gov

Update On The Wind Turbines Of Madison County Midamerican Energy Prevails In Lawsuit May Add 30 More Turbines

Are You Blown Away By The Power Of Wind You Should Be Renewable Energy Alternative Energy Energy

Form 59 458 Download Fillable Pdf Or Fill Online Notice Of Transfer Or Change In Use Of Property Claimed For Homestead Tax Credit Or Military Service Tax Exemption Iowa Templateroller

Black White Landscape Photography Scotland Mountain Etsy Scenery Photos Black And White Landscape Landscape Photography

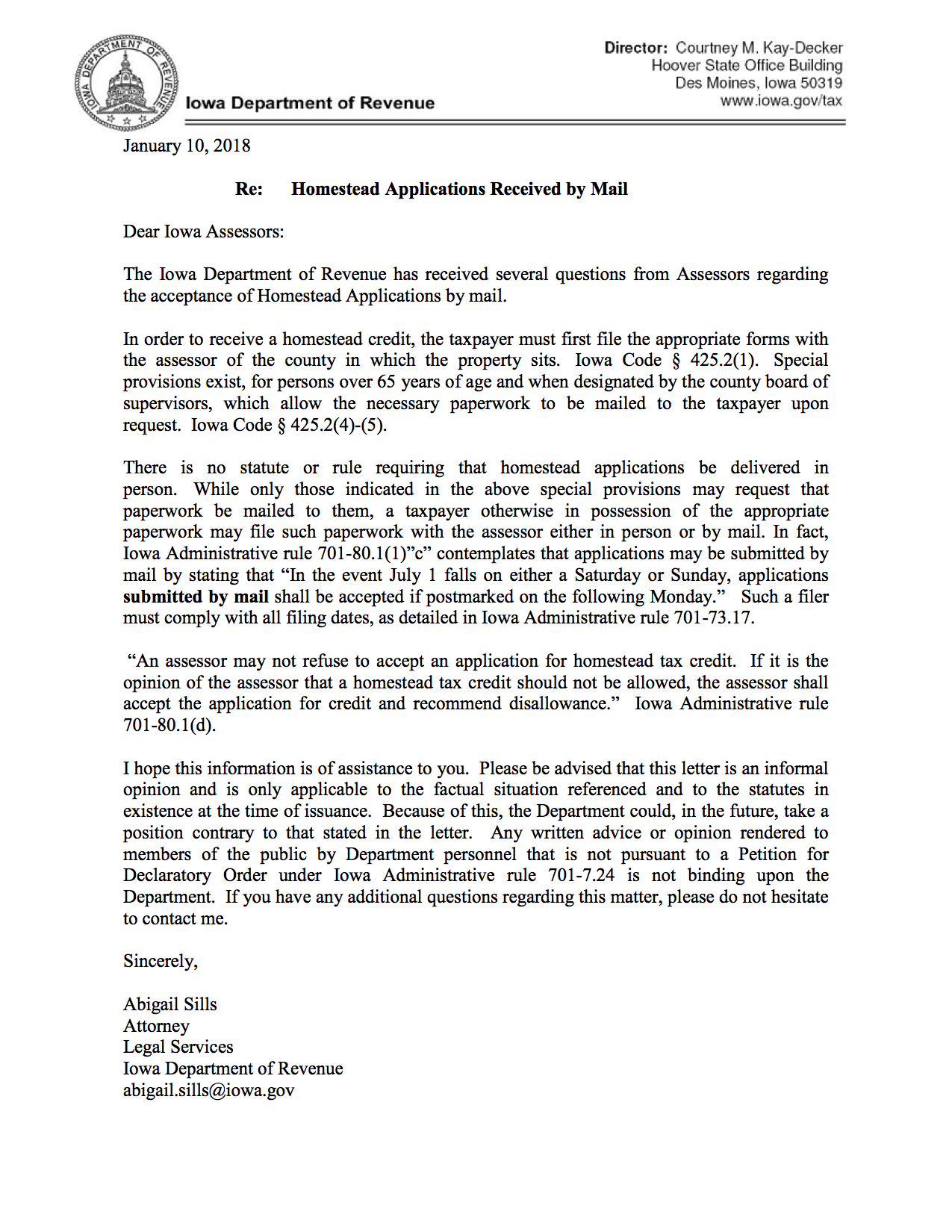

Update Regarding Homestead Tax Credit Applications Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

Form 59 458 Download Fillable Pdf Or Fill Online Notice Of Transfer Or Change In Use Of Property Claimed For Homestead Tax Credit Or Military Service Tax Exemption Iowa Templateroller

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

How To Keep Water From Freezing In A Stock Tank Ehow Uk Farm Business Farming Business Hobby Farms

Money Creation In A Fractional Reserve Banking System The Simplified Cartoon Version Money Creation Banking Monetary Policy

/cloudfront-us-east-1.images.arcpublishing.com/gray/KTWHUCEPO5M35BN7EVF4E4XJLE.jpg)